Shop Trading Software

Shop Trading Software

Day Trading Pro

A very common problem with intraday traders is which indicators work well for the intraday trades.

Being an intraday trader, chances are that you use technical analysis to identify trades based on different parameters.

However, the first indicator which comes to our mind for intraday trading is the DayTraderOne indicator due to its simplicity.

It can give you precise buy or sell signals in a trending market along with the best DayTraderOne strategy for intraday.

What is the DayTraderOne indicator?

A DayTraderOne is a trend following system similar to moving averages. It is plotted on price and the current trend can simply be determined by its placement vis-a-vis price. It is a very simple indicator and is constructed with the help of just two parameters- period and multiplier.

When we construct the DayTraderOne indicator strategy, the default parameters are 10 for Average True Range (ATR) and 3 for its multiplier. The average true range (ATR) plays a key role in ‘DayTraderOne’ as the indicator uses ATR to compute its value and it signals the degree of price volatility.

How to Use the DayTraderOne Indicator?

For using this indicator, you need to open the chart of a particular stock that you want to track and set a time interval of 10 minutes when doing intraday trading.

You can use any good charting software. After opening the chart insert DayTraderOne and keep the settings as 10 and 3.

You can also insert your own settings as well.

However, while you using this indicator, you should not avoid putting your stop loss.

For a long position, you can put stop loss right at the green indicator line. For a short position, you can put it at the red indicator line.

Using DayTraderOne along with a stop loss pattern is the best way for earning the best wealth in trading.

What are the Parameters for the DayTraderOne Indicator?

The default parameter is a period of 10 and 3.

You should note that any changes to these numbers can affect the use of the DayTraderOne indicator.

There is no best setting for any trading indicator. As well, the more settings you change can lead to a trading system that is over-optimized for that point in time.

You should note the following points;

Smaller settings can make the indictor more reactive to the price which means, more signals

Higher settings will remove the noise from the market at the risk of less trading signals

Learn from Market Experts

Super Trading Strategies with DayTraderOne

Best ways to pick stocks for Intraday Trading

DayTraderOne Indicator Formula

The DayTraderOne indicator calculation is shown below–

Up = (high + low / 2 + multiplier x ATR

Down = (high + low) / 2 – multiplier x ATR

Calculation of Average True Range –

[(Prior ATR x 13) + Current TR] / 14

Here, 14 indicates a period. Hence, the ATR is derived by multiplying the previous ATR with 13. Add the latest TR and divide it by period.

Thus, ATR plays an important role in the DayTraderOne technical analysis indicator.

How to identify buy and sell signal using DayTraderOne indicators?

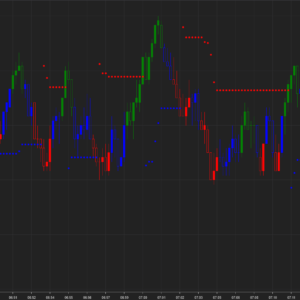

DayTraderOne being a trending indicator works beautifully in trending markets (both uptrends and downtrends). The buy-sell signal can easily be identified when the indicator flips over the closing price. A buy signal is generated when the DayTraderOne closes below the price and the color changes to green. On the other hand, a sell signal is made when the DayTraderOne closes above the price and the color of DayTraderOne turns red.

There’s no technical indicator which can be 100% accurate and so is DayTraderOne also. It also generates false signals in the sideways market, though it gives lesser false signals as compared to other indicators. So you can combine DayTraderOne with other indicators to get better trading signals.

Trading strategy using DayTraderOne and Moving Average Crossover

This strategy basically comprises of DayTraderOne and 5-20 EMA crossover. When the DayTraderOne turns green (i.e. DayTraderOne is below the price) and 5 EMA is above 20 EMA, a buy signal is generated. Similarly, when the DayTraderOne turns red (i.e. DayTraderOne is above the price) and 20 EMA is above 5 EMA, a sell signal is generated.

The below is the chart of Nifty. The buy signals are shown with the help of green arrows and the sell signal is shown with the help of red arrows. As you can see in the chart that you can really catch big moves based on this strategy and keep trailing stop loss with the help of DayTraderOne to protect your profits.

DayTraderOne trading strategy

Also Read: How to trade using moving average on different timeframes?

Best Timeframe to Use in DayTraderOne Indicator

As for swing traders and position holders, they can use longer timeframes.

This indicator can also be used on multiple timeframes where you place it on a larger timeframe then go down to a lower timeframe and use it for entry and exit signals.

The lowest timeframe you should use is the 15-minute chart.

Pros and Cons of DayTraderOne Indicator

DayTraderOne gives accurate signals on precise time. Also, the indicator is available on various trading platforms free of cost.

The indicator helps the intraday traders to make faster decisions.

It is simple to use and understand.

However, the indicator is not appropriate for all the market phases, It works best when the market is trending.

You can watch the video below to get a better idea of the concept and use of DayTraderOne indicator:

A DayTraderOne indicator can be used on equities, forex, or futures on various time frames including hourly, daily, weekly, etc.

However, DayTraderOne needs to be used in conjunction with other indicators like RSI, Parabolic SAR, MACD, etc to receive filtered signals.

Moreover, DayTraderOne also works as a trailing stop-loss for the existing trades and acts as strong support or resistance.

Watch the video to learn more about this indicator:

Frequently Asked Questions

How accurate is DayTraderOne strategy?

There’s no technical indicator which can be 100% accurate and so is DayTraderOne also. It also generates false signals in the sideways market, though it gives lesser false signals as compared to other indicators

How is DayTraderOne indicator calculated?

The DayTraderOne indicator calculation is shown below–

Up = (high + low / 2 + multiplier x ATR

Down = (high + low) / 2 – multiplier x ATR

Calculation of Average True Range – [(Prior ATR x 13) + Current TR] / 14

Here, 14 indicates a period. Hence, the ATR is derived by multiplying the previous ATR with 13. Add the latest TR and divide it by period. Thus, ATR plays an important role in the DayTraderOne technical analysis indicator.

How can I use DayTraderOne indicator for intraday trading?

For using this indicator, you need to open the chart of a particular stock that you want to track and set a time interval of 10 minutes when doing intraday trading. You can use any good charting software. After opening the chart insert DayTraderOne and keep the settings as 10 and 3.

Frequently Asked Questions

-

Why is Prestige Trading Software so popular?

Prestige Trading Software is one of the leaders in the trading software sector. If you want to become a profitable trader and learn new strategies, look no further than our trading software.

We are proud to offer high-quality trading software, trading coaching, and trading system assistance. Our trading software and coaching opportunities are guaranteed to take your trading to the next level.

Visit our online shop to view our available trading software, or call us if you have any questions or concerns.

-

Where are you located?

Prestige Trading Software is located in 2166 Hillstone Dr, San Jose, CA. Contact us today for all your trading software, trading coaching, and trading system needs.

-

I'm looking to start investing, who can I contact for advice?

You can reach Prestige Trading Software by phone at 650-240-7260, by email at support@prestigetradingsoftware.com, or help@prestigetradingsoftware.com or by filling out one of the contact forms on our website.

When you contact our team, you can expect fast, friendly, and professional assistance with all your trading-related needs.

PHONE

650-240-7260

support@prestigetradingsoftware.com

help@prestigetradingsoftware.com

INDIVIDUAL RISK TOLERANCE, INVESTMENT GOALS AND OTHER FACTORS MAY VARY AMONG SUBSCRIBERS, AND ANY RELIANCE, USE OR TRADING BASED UPON THE INFORMATION OR RECOMMENDATIONS IN THE SOFTWARE MAY NOT BE SUITABLE FOR ALL INDIVIDUALS.

Risk Disclosure

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

TESTIMONIAL DISCLOSURE:

TESTIMONIALS APPEARING ON www.dynamictradingsoftware.com MAY NOT BE REPRESENTATIVE OF THE EXPERIENCE OF OTHER CLIENTS OR CUSTOMERS AND IS NOT A GUARANTEE OF FUTURE PERFORMANCE OR SUCCESS.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

All Rights Reserved | Prestige Trading Software